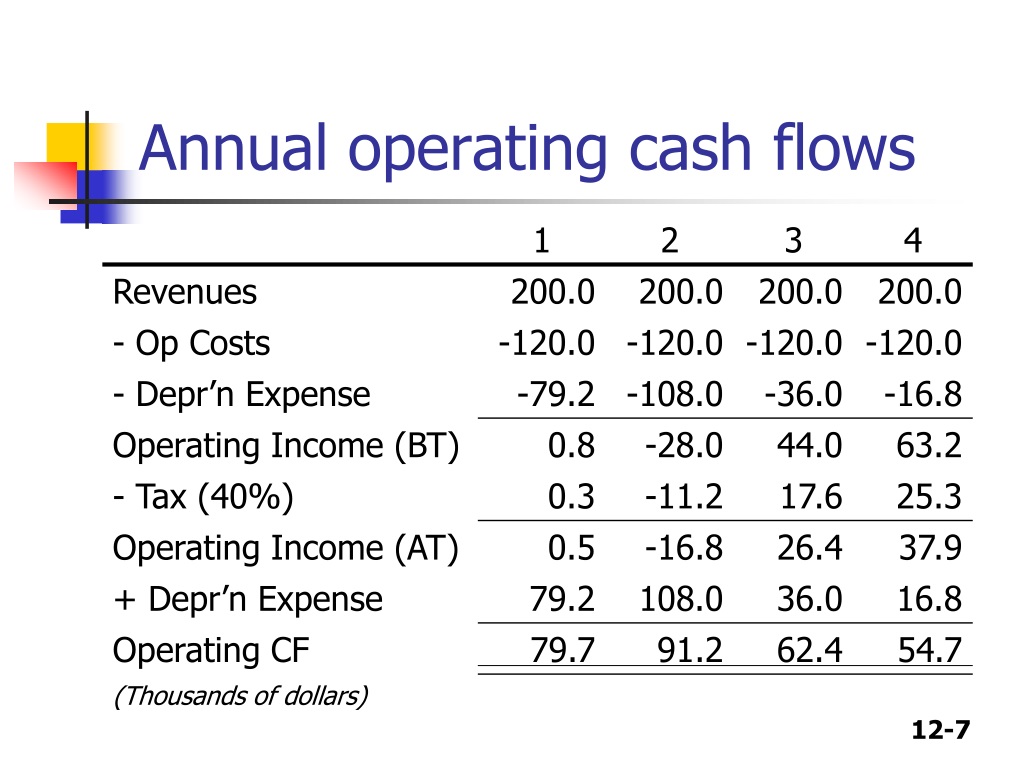

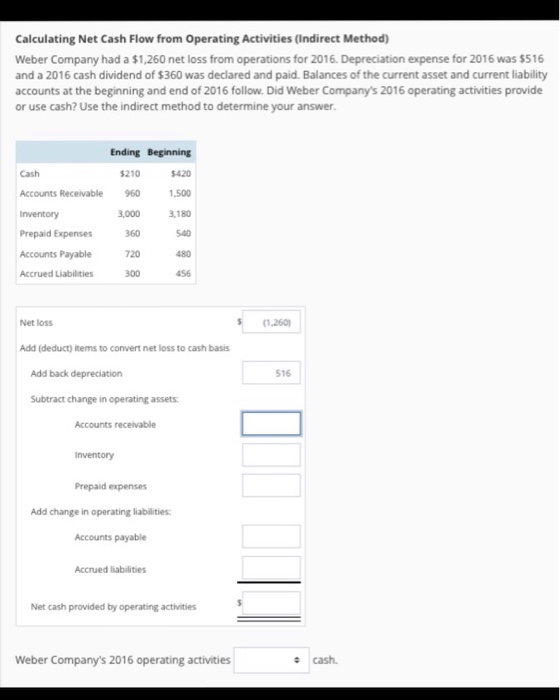

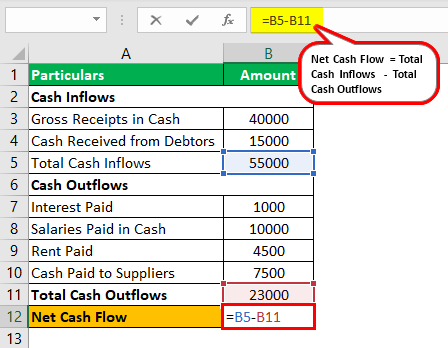

To calculate the operating cash flow, you subtract operating expenses from total revenue. Direct methodīelow is an example calculation using the direct method:Ī company has total revenues of $1,200 and overall operating expenses totaling $700. Here are a few examples of calculations made using direct and indirect methods. Related: Net Cash Flow Formula (With Examples) Example calculations of operating cash flow For this reason, it's best to take an overall measurement of the company's cash trends to get an idea of how accurate the most current calculations are. Knowing what's involved in this calculation helps investors be more aware of the way a company can manipulate operating cash flow by postponing inventory orders and stretching out the payment terms on the bills to keep their cash longer and shortening the payment terms on receivables to get cash faster. To comply with GAAP, most companies adhere to the indirect method, which is more complex than the direct method but provides much more information. Most business owners who stay vigilant in keeping track of day-to-day expenses and revenues can forecast their cash flows and make better business decisions confidently. Producing all the financial statements required for a business can be overwhelming, but it's important to keep up with them as a business grows. Related: Using the Indirect Method to Prepare a Cash Flow Statement Why operating cash flow is important Taxes are the amount of money an organization pays to operate in its locationsĬhange in working capital is any difference in the money an organization has to create and sell products or services Revenue is the amount of money an organization earns from sales during the accounting periodĬost of sales is how much money the organization pays to make revenue during the accounting periodĭepreciation is the value assets lose during the accounting period

Operating cash flow = (revenue – cost of sales) + depreciation – taxes +/- change in working capital The indirect method adjusts the net income to cash by using changes to non-cash accounts, such as depreciation, accounts payable and accounts receivable.

#CALCULATING OPERATING CASH FLOW HOW TO#

Read more: How To Use the Direct Method for the Cash Flow Statement 2.

Operating expenses are the costs of running the organization during the accounting period

#CALCULATING OPERATING CASH FLOW FULL#

Total revenue is the full amount of money an organization earns from sales during the accounting period Operating cash flow = total revenue - operating expenses The direct method of calculating operating cash flow is: While it's the simplest and most accurate method, the direct method requires a supporting reconciliation, according to the Generally Accepted Accounting Principles (GAAP). This method processes transactions such as cash paid by customers, interest income and dividends, employee salaries, cash paid to vendors and income tax/interest paid. The direct method is when a company records all transactions as cash, subtracted and added as the transactions take place. There are two methods with respective formulas businesses use to calculate operating cash flow: 1. Related: A Guide to Cash Flow: Definition, Importance and FAQs How to calculate operating cash flow The operating cash flow calculation includes the following components:ĭepreciation on property, equipment and machinery As part of the cash flow statement, the operating cash flow calculation can provide the best overall view of the company's core business operations and how they contribute to the company's financial health. Operating cash flow excludes financing and investment activities, so the focus remains on whether the company can pay expenses related to normal operations, allocate capital for reinvesting into the business and satisfy the company's debts and pay dividends to stakeholders. Positive operating cash flow provides a company with solvency over a long period, while negative operating cash flow can show that the company borrows money to pay its bills. Operating cash flow provides insight into the health and stability of the core of the company. It's the first section of the cash flow statement and represents cash flows of operating activities, excluding financing investing activities, to focus on the operational cash flows of the core functions of the company. Operating cash flow shows the company's ability to generate funds from the core operations of the business.

0 kommentar(er)

0 kommentar(er)